Zomato announced on Friday that it had reduced losses in the March quarter, both year over year (YoY) and sequentially. The company’s overall net loss decreased from Rs 360 crore a year ago and Rs 345 crore a quarter ago to Rs 188 crore.

To reach Rs 2,056 crore, total revenue grew by a staggering 70% year over year. The actual net loss was a lot less than the projected Rs 356 crore. However, the actual revenue was a little less than the expected Rs 2,122 crore.

Zomato’s loss in FY23 decreased from Rs 1,209 crore to Rs 971 crore. The amount of revenue rose 69% to Rs 7,079 crore.

Zomato total sales stood at Rs 1,530 crore for the quarter, compared to Rs 1,284 crore previous year’s Q4. Business-to-business (B2B) revenue increased from Rs 194 crore to Rs 478 crore in the past year. Compared to Q3 revenue of Rs 301 crore, Blinkit business recorded revenue of Rs 363 crore.

“In food delivery, over the last five quarters, we have improved our margins meaningfully while further strengthening our market position,” mentioned Deepinder Goyal, MD and CEO of Zomato.

“We will continue with the same mindset as we look to further expand the adjusted EBITDA margin (from the current 1.2%) to our stated goal of +4-5% of GOV,” mentioned Goyal. TAt the current level of the food delivery, this would result in an annual cash operating profit of Rs 1,000–1,300 crore.

Zomato still has a long way to go in terms of profit expansion in the rapid commerce industry. However, in March, contribution positive stores accounted for more than 65% of the gross order value.

A few locations have even exceeded the 5% contribution margin threshold, and the firm anticipates that at some point in the future, it will apply to the mature portions of its network as a whole.

“We believe we are the most cost efficient and the largest quick commerce business in India today,” Goyal said.

The Stocks of Zomato rose to an intra-day high of 66.40 a piece after closing at 63.50 on Monday.

The Stocks has given a return of 17.71% in the last month.

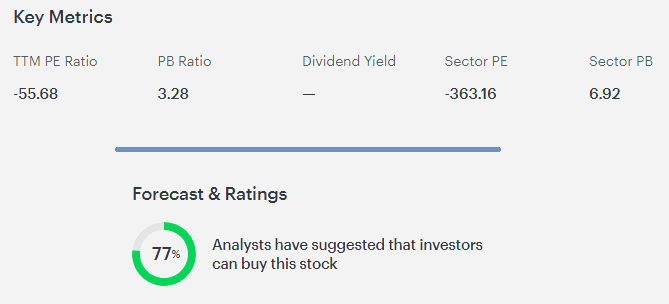

The Stocks are trading at a book value of 3.28 which is much lower than the sector average of 6.92

As per Tickertape, 77% of Brokerages have given a ‘Buy‘ call on Zomato.