Tata Motors announced on 12 May that it had achieved a consolidated profit of Rs 5,407.79 billion for the March quarter, compared to a loss of Rs 1,032.84 billion in the same period last year.

The revenue from operations was Rs 1,05932.35 crores, an increase of 35.05% over Rs 78439.06 crores in the same quarter last year.

The Tata Group’s Board of Directors recommended a final Dividend of Rs. 2 per ordinary share.

“The year finished on a high note, with multiple records being set in the automotive industry. Each business’s distinct strategy is working together to produce a dramatic improvement in the overall results. We remain confident in our ability to grow and generate cash flow, to meet our stated goals,” said PB Baliaji, Tata Motors’ Group Chief Financial officer.

In its outlook for this year’s financial results, the company said that it is optimistic about the situation of demand despite short-term uncertainties. It also expects moderate inflation in the near future.

In this context, our goal is to improve further and deliver a solid performance in FY24. “We expect the momentum to continue throughout the year, taking into account seasonality, JLR’s supply chain stabilization and India’s post-RDE impact,” said the release.

Jaguar Land Rover Segment

Tata Motors, the UK-based luxury vehicle unit of Jaguar and Land Rover, reported revenues in Q4 totaling Rs. 730000 crores. The chip supply has improved, resulting in a revenue increase of 49%. In Q4, wholesales were 94649 units. This is a 24% increase YoY.

EBITDA margin was 6.5% for the quarter, while profit before taxes and exceptional items was Rs. 3784 crore. In Q4, free cash flow was 83814 crores.

As of 31 March 2023, the net debt of JLR was 308520 crores with cash of 390792 crores and liquidity of $545052 crores.

Despite increased retail sales, the company’s order book of 2,000,000 units is still strong. Range Rover, Range Rover Sport, and Defender make up 76 percent.

“JLR delivered a strong set of results for the fourth quarter. We increased production and delivered revenue, profit, free cash flow and wholesales growth as chip supply continued to improve. For the fiscal year ahead, while we are mindful of the headwinds that remain, our target is to increase EBIT margins to over 6 percent and deliver significantly positive free cash flow to reduce our net debt further, while increasing investment to £3 billion,” said Adrian Mardell, Jaguar Land Rover’s Interim Chief Executive Officer.

Commercial Vehicle Segment

In the commercial vehicle sector, revenue for Q4 was Rs 21,200 crores, an increase of 14.6%. Profit before tax was Rs 1,700 crore.

The Commercial Segment domestic wholesales for the third quarter rose by 2.4% YoY. At the same time, the domestic retail increased by 6%.

The company announced that it had begun deliveries of ACE EVs. This marks a significant leap in providing sustainable mobility solutions. The company said that its smart city mobility business is continuing to grow. They have signed a definitive contract for the operation of 1,500 buses in Delhi, 921 in Bengaluru, and 200 in Jammu & Kashmir.

Private Vehicle Segment

Tata Motors reported that its revenue from passenger vehicles was Rs 12,100 crore in Q4, up 15.3% YoY. EBITDA margins and EBIT improved to 7.3% and 1.4%, respectively. The margins improved due to higher volumes, better realizations and operating leverage.

Tata Motors anticipates that the growth of the automotive industry will moderate in the future due to the strong base effect, as well as other macro-factors such as a rising interest rate, inflation and the cost impact of progressive regulatory standards. It added that the electrification trend will continue to grow.

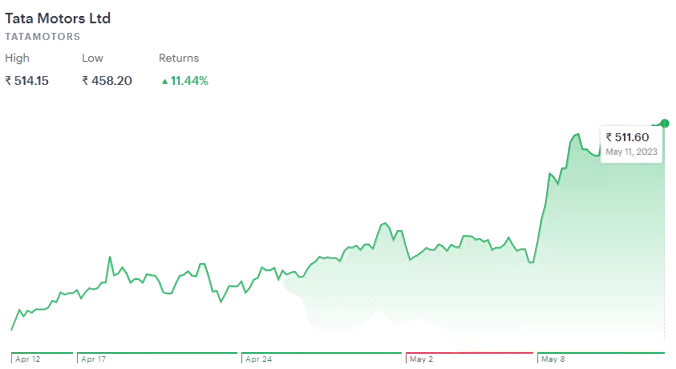

The Stocks of Tata Motors have risen 11% in the previous month and was trading at 515.95 in NSE on Friday.

Turtle Wealth, a SEBI-registered Portfolio Managers, said that they were watching to see if the growth continues and only moves upward in the next quarters.