The largest bank in the nation, State Bank of India (SBI), on Thursday declared a net profit of Rs. 16694 crore for the quarter which ended in March 2023. It is an increase of 83% from Rs.9113 crore, which was the net profit in the same quarter last year. Readers can access the detailed financial report of SBI here.

Its Net interest income (NII) increased by 29.5% to Rs.40392 crore in the fourth quarter of FY23. NII for the same quarter in the previous year stood at Rs. 31197 crore. SBI’s domestic net interest margin (NIM) rose to 3.84% for Q4FY23, up 44 basis points from the same quarter last year.

Operating profit increased by 24.87% YoY to Rs.24621 crore during the quarter.

During the quarter, the asset quality of the public sector lender improved. Gross non-performing assets (NPA) were down 7.5% from the previous quarter to Rs. 90927 crore (Q4FY23), from Rs. 98347 crore. In terms of QoQ, Net NPA fell by 8.6% to Rs.21466 crore from Rs.23484 crore.

Sequentially, the Gross NPA ratio reduced by 36 basis points to 2.78% from 3.14% while the Net NPA ratio decreased by 10 basis points to 0.67% from 0.77%.

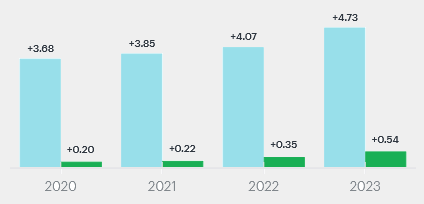

Profit Talk

SBI’s net profit for FY23 increased by 58.58% YoY to reach Rs. 50232 crore, crossing the Rs. 50000 crore threshold.

Provision Coverage Ratio (PCR) increased by 135 basis points year over year to 76.39%. For Q4FY23, the slippage ratio was 0.41%. The bank’s slippage ratio for FY23 increased by 34 basis points YoY to 0.65%.

Additionally, the bank’s board recommended an FY23 dividend of Rs. 11.30 per equity share. According to the bank, the dividend will be paid on June 14, 2023.

According to SBI, credit growth was 15.99% YoY, with domestic advances expanding by 15.38% YoY, driven by retail personal advances (up 17.64% YoY) and SME advances (up 17.59% YoY).

Loans for agriculture and businesses both grew year over year by 13.31% and 12.52%, respectively.

Credit Cost for the quarter improved by 33 basis points YoY to 0.16%.

The growth rate for all bank deposits was 9.19% YoY, with the CASA deposit growing by 4.95% YoY. CASA ratio as of March 31, 2023, is 43.80%.

Stock Talk

On Friday, 19th May 2023, SBI shares were up 1.7% after results were declared and were trading at Rs.581.20 a share on the BSE at 1:00 p.m.

It may be noted that the stock of SBI has risen over 5% in the last month.

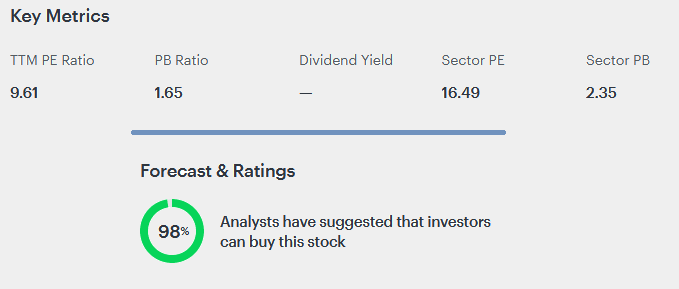

SBI’s fundamentals are also looking very good right now. It is trading at a P/E ratio of 9.61 against the sector average of 16.49, which makes it an attractive ‘Buy‘.

As per Tickertape, 98% of the Brokerages have maintained a ‘Buy’ rating on the script.