State-owned REC Ltd reported on Wednesday a 33% increase in its consolidated net profit at Rs 3,065.37 crore. It had reported a net profit of Rs 2301 crore during the same quarter of previous year.

According to REC in a regulatory filing, the business recorded a net profit of Rs 2,301.33 crore during the January-March quarter of FY 2021–22.

The company’s overall revenue for the fourth quarter increased from Rs 9,655.99 crore to Rs 10,254.63 crore. Instead of 6,798.68 crore, total expenses were cut to 6,353.40 crore.

The net profit for the full FY23 increased from Rs 10,035.70 crore in FY22 to Rs 11,166.98 crore.

Additionally, the revenue increased from Rs 39,339.20 crore to Rs 39,520.16 crore.

REC Ltd reported Rs 41.86 in earnings per share (EPS) for the fiscal year that ended on March 31, 2023. This is up from Rs 38.02 in the same period of previous year. This shows a growth in earnings and emphasizes the company’s upward trend.

New Financial Milestones

The 12-month FY23 period saw significant operational and financial milestones accomplished by REC Ltd. Disbursements increased from Rs 64,150 crore to Rs 96,846 crore in comparison to the prior year. The amount of interest earned on loan assets increased by 1% to Rs 38,360 crore from Rs 37,811 crore the year before.

Notably, as of March 31, 2023, REC Ltd has reduced its net credit-impaired assets to 1.01% and had a provision coverage ratio of 70.64% for non-performing assets (NPA), indicating an improvement in asset quality.

The company has a capital adequacy ratio of 25.78%, which lays a strong basis for future growth.

New Developments

For four interstate transmission projects that will be carried out using a tariff-based competitive bidding mode, the company also approved a proposal to incorporate project specific special purpose vehicles (SPVs) as fully owned subsidiary companies of REC’s arm, REC Power Development and Consultancy Limited (RECPDCL).

New Appointments

The board also approved Hemant Kumar’s appointment as REC Ltd’s Chief Compliance Officer for a term of three years beginning on May 6, 2023.

A non-banking finance firm operating under the Ministry of Power, REC Ltd., is dedicated to India’s power industry funding and growth.

The Stocks of REC has risen 49% in the last year and were trading at 133.10 on Wednesday.

Company’s Fundamentals

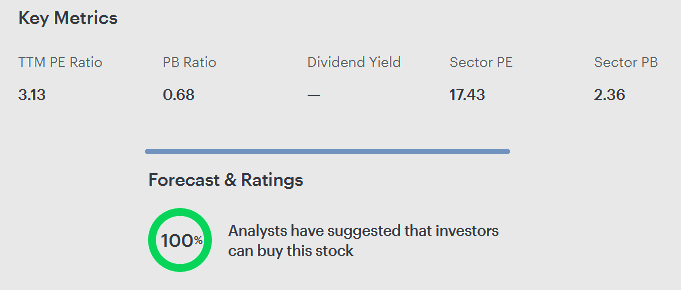

The Stocks of REC is trading at a PE Ration of 3.13, which is much below the sector average of 17.43

Further it is trading at abook value of 0.68, which is also much lower than the sector average of 2.36