RBL Bank, a private sector lender, registered a YoY increase of 37% in its net profit for the quarter ended March 31, 2023. The PAT grew 30% quarter-on-quarter. The bank’s interest income grew by a single digit, but its provisions dropped sharply. The bank’s asset quality has continued to improve.

Net interest income (NII), which is the difference in interest earned and spent, was 1,211 cr. This represents a growth of 7% YoY as well as 5% QoQ. The net interest margin was 5.01% for the third quarter.

The provisional amount dropped 41%, from 401 crore to 235 crore during Q4FY23. The decrease was 20% from the 293 million in provisions recorded in Q3FY23.

Gross non-performing assets (GNPA), which are the total of all non-performing assets, decreased to 3.37% during Q4FY23 from 3.61% in the Q3 of the same fiscal. Gross non-performing assets (GNPA) stood at 4.40 % in Q4 FY22.

Net NPA fell to 1.10% Q4FY23, compared with 1.18% Q3FY23.

RBL’s deposits increased by 7% year-on-year and 4% quarter-on-quarter to 84.887 crore. CASA grew by 14% YoY, 6% QoQ, and 31,717 crores. The CASA ratio was 37.4% during the review period. Retail deposits at the bank grew by 18% year-on-year and 4% quarter-on-quarter to a total of 36,319 crores.

Net advances outpaced deposit growth by 17% YoY, and 5% QoQ, to reach 70,209 crore. Retail advances grew by 21% YoY, and 8% sequentially, to a total of 37,778 crores. Retail disbursements also increased to 4,391 billion.

The bank also saw a staggering 86% growth YoY in its housing loans. The lender’s rural vehicles finance reached the milestone of 1000 crore.

The bank issued 5.5 lakh cards in this quarter — bringing the total to 4.4 million cards. The total number of customers has risen by 16% to 12,91 million in the past financial year.

RBL Bank has good capitalization and liquidity. The bank’s capital adequacy ratio was 15.3% and its Common Equity Tier 1 was 16.9%. The average liquidity coverage ratio was 126%.

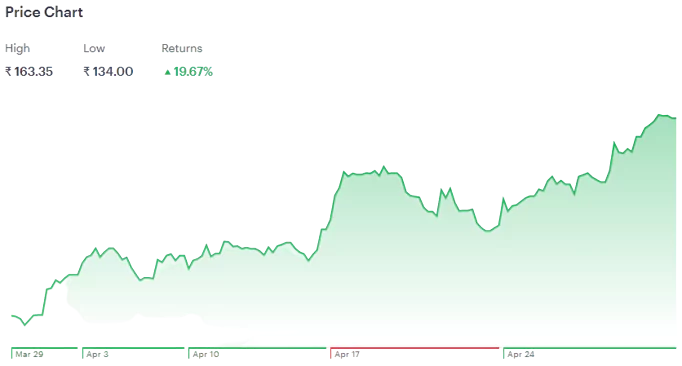

The Stocks of RBL Bank has given a healthy return of about 20% in the last month. The stocks were trading at 161.80 on Friday with a PE ration of 12.16 which is much lower than the sector’s PE ration of 19.78

In a meeting on Saturday, the board of RBL Bank declared a 15 percent dividend per equity share with a nominal value of 10 dollars. This will be paid subject to approval by the shareholders at the next Annual General Meeting (AGM).