ITC, a prominent player in the FMCG industry declared its Q4 FY22-23 results on Thursday. Its standalone net profit for the March quarter stood at Rs 5086 crore. This is a 21.37% rise year over year (YoY) to from Rs 4190 crore in the same quarter previous year. Analysts had anticipated earnings increase in the range of 13% to 21%.

In comparison to the same quarter previous year, revenue for the quarter increased by 6.14% YoY to Rs 17224 crore from Rs 16226 crore. This essentially matched expert projections. Revenue from the cigarette category for the quarter were Rs 7355 crore, an increase of 14% from Rs 6443 crore in the same quarter previous year. PBIT for the division increased 14% year over year.

Revenue for the FMCG (Others) category was Rs 4944 crore vs Rs 4141 crore year over year.

Revenue for the hotels sector increased by 100% YoY, from Rs 389.64 crore to Rs 781.71 crore. Sales for the agribusiness fell to Rs 3578 crore from Rs 4366 crore year over year. Revenue from the paperboard segment was stable year over year at Rs 2221 crore vs Rs 2182 crore.

EBIDTA margin increased 385 basis points year over year during the quarter to 36.1.

Results Narrative

The pandemic-related operational difficulties of the previous two years came to an end in FY23, according to ITC.

ITC further stated that the Global commodity and energy prices, meanwhile, have seen extraordinary inflation and volatility. This is due to the rise of geopolitical tensions, ongoing supply chain disruptions, and the climate issue. Global central banks quickly increased interest rates in a very short period of time as a response. In spite of the global slump, the Indian economy remained a bright point in FY 2022–23.

Consumption demand remained weak, particularly in rural areas and for discretionary categories in urban markets, according to ITC, as high inflation ate into household budgets. Despite a difficult operating environment, the business was able to report solid results across all operational sectors thanks to aggressive strategic initiatives.

Dividend Declared

The corporation, which has its headquarters in Kolkata, declared a final dividend of Rs 6.75 and a special dividend of Rs 2.75 for FY23. If announced, the dividend will be paid between August 14 and August 17, according to an NSE filing by the business.

The FMCG firm established May 30 as the record date for establishing a member’s eligibility for dividend distribution.

The total dividend for FY23 will be Rs 15.50 per share, including the interim dividend of Rs 6 per share that was announced by the board on February 3. The 112th AGM’s date will soon be released by the corporation. At 3:00 PM on the BSE, shares of ITC were down 1.84 percent at Rs 419.80. The stock has so far had the second-best Nifty performance in 2023.

The total cash outflow for dividends for the year will be Rs 19255 crore, including the interim dividend of Rs 7448 crores paid in March 2023.

Fundamentals

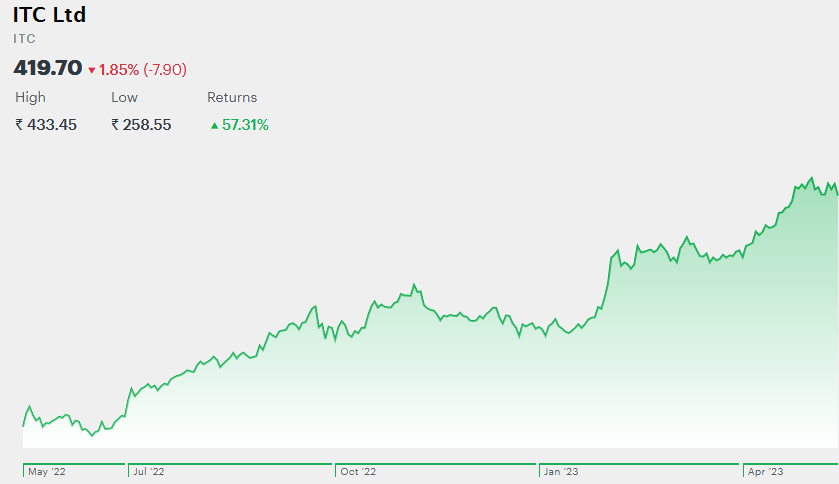

The Stocks of ITC Ltd were trading at 419.70 a piece on Thursday at NSE. It has risen 57.31% in the last 52 weeks.

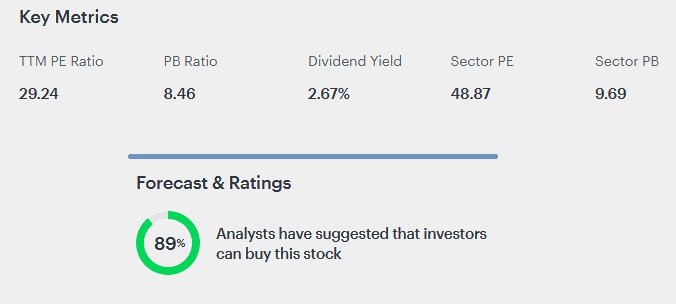

The stocks are operating at a PE ration of 29.24 which is much lower than the sector average of 48.87

As per Tickertape, 89% of Brokerages have maintained a ‘Buy‘ call on the stock.