ITC Ltd, an Indian conglomerate offering everything from cigarettes to hotels, became just eleventh company ever listed on an Indian stock exchange to surpass Rs 5 trillion of market capitalization, marking an exceptional 21 percent jump year-on-year for its shares.

ITC Stocks hit record highs of 402.60 Rs on Tuesday morning and intraday gains reached 1.1 percent, reaching Rs 402,30 at 9.30am trading 1.2 higher than its close on the previous day and its market capitalization reaching Rs 5,01 trillion.

Reliance Industries Ltd, Tata Consultancy Services Ltd, HDFC Ltd and Infosys Ltd were among those which already accomplished this milestone, along with Hindustan Unilever Ltd and life Insurance Corp of India at State Bank Of India as well as HDFC Ltd and Bharti Airtel Ltd.

ITC has delighted its investors by consistently outshone in all segments – FMCG and paper being particularly noteworthy examples of outstanding performances by ITC.

Investors appreciate ITC due to its consistent dividends and cash flows, along with solid operational performance that includes double-digit increases in both its cigarette market share and hotel divisions, creating further appeal among investors.

Analysts contend that ITC has shown resilience despite an uncertain environment for demand and inflationary pressure on margins in recent quarters, due to various factors including its successful post-Covid market recovery; consistent double digit growth for non-cigarette FMCG businesses; as well as rapid expansion within paperboard, packaging, and paper.

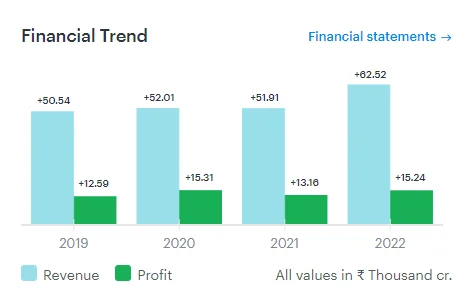

Motilal Oswal Securities believes ITC has demonstrated exceptional earnings growth both during FY23 and the past two years, including 23% year-on-year increase and CAGR over two years expected of around 15% for its earnings growth outlook for both periods. Our forecast calls for ITC outperforming other large staples companies when measured against expected EPS growth for both FY23 and 24 periods.

Recently, amendments were made to the Finance Bill 2023 that set compensation cess for tobacco products at Rs 4,170/1,000 sticks plus 290% ad valorem – this should not impact ITC’s cigarettes business adversely. Analysts suggested this change should have no significant negative ramifications on its growth strategy.

Expect volume growth in the cigarette industry over the coming quarters. We anticipate double digit expansion for non-cigarette FMCGs like FMPG, while operating profit margin (OPM, which was 10 percent in Q3) should gradually improve over time. Meanwhile, hotel sector should see benefits from industry tailwinds; ITC stands out among its large competitors with greater earning visibility (an 18 percent compound annual compound growth between FY2022-FY2025)”, Sharekhan recently stated.

Analysts anticipate that ITC will maintain its momentum for volume growth due to no planned price hikes and government efforts to curb illicit sales of cigarettes. Furthermore, FMCG non-cigarette business should remain robust; hotel and PPP businesses may even show improvement; ultimately this should translate into double-digit growth in revenues and profit after tax (PAT) over the coming two years for ITC.

Current valuation estimates put ITC stock at 25.5x, 22.8x and 20.6% of its respective FY2023, FY2024 and FY2025 earnings respectively – placing it below that of many large consumer products companies. Earnings at ITC should benefit from strong growth prospects for core cigarette and FMCG businesses as well as margin expansion; according to Sharekhan report these factors should lead to consistent increase in valuation over time.