For the three months ending in March, Indian Oil Corp. recorded a 52% increase in its consolidated net profit at Rs 10,841 crore. In the same period last year, it was Rs 7,089 crore.

In the March quarter, operating revenue increased 10% year over year (YoY) to Rs 2.30 lakh crore from Rs 2.09 lakh crore in the same period of the previous year.

On a sequential basis, the net profit more than doubled from the Rs 890 crore recorded in the December quarter before. The continued recovery in auto-fuel marketing margins is what is responsible for the substantial sequential rise in profitability.

In contrast to losses in the third quarter, OMCs’ marketing margins on diesel went positive in the fourth quarter. However, from Rs 2.32 lakh crore in the third quarter, revenues slightly decreased (0.6%) from quarter to quarter.

Dividend Announced

The Board has furthermore announced a final dividend for 2022–2023 of 30%, or Rs.3 per equity share. The shareholders must approve the aforementioned dividend payment at the annual general meeting (AGM).

Within 30 days of the AGM’s declaration date, the dividend would be paid. The record date for the final dividend payment will be determined and announced in due course.

Revenue from petroleum products increased 11% YoY to Rs 2.20 lakh crore. Petrochemicals business revenue decreased 27% to Rs 6,282 crore YoY.

For the quarter under review, revenue from other business operations increased 21% to Rs 8,798 crore. In the same quarter of the previous year, it was Rs 7,253 crore.

Indian Oil’s net profit for the fiscal year that ended in March 2023 more than halved to Rs 11,704 crore from Rs 25,726 crore the previous year.

From Rs 7.36 lakh crore in FY22 to Rs 9.51 lakh crore in FY23, revenues climbed by 29%. On Tuesday, NSE shares for Indian Oil was trading 3.27% higher at Rs 86.9.

The Stock of IOCL has risen 9.49% in the last one month.

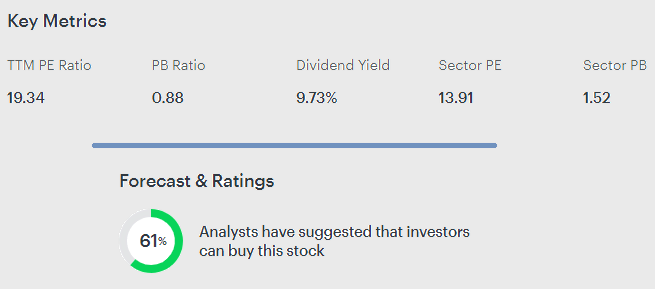

The stock is still trading at a book value of 0.88 against the Sector average of 1.52 which makes it an attractive ‘Buy‘

As per Tickertape, 61% of the Brokerages have also maintained a ‘Buy‘ rating on Indian Oil Corporation Ltd.