The power of compounding is one of the personal finance ideas with the greatest potential for long-term wealth building. Compounding, sometimes called the “eighth wonder of the world” by renowned scientist Albert Einstein, is a power that, over time, may turn modest resources into huge riches. One’s financial future may be dramatically impacted by comprehending the nuances of compounding and putting a well-thought-out plan into practice. This article digs into the compounding effect, examines how it works, and provides helpful advice on how to use it to your advantage for long-term financial success.

Defining Compounding and its Mechanics

In the context of finance, compounding is the act of generating returns on both the initial investment and the cumulative earnings from earlier periods. It runs on the straightforward tenet of “earning on earnings.” The potential for further returns to be generated by the cumulative returns over time can exponentially speed up the accumulation of wealth.

The rate of return and time play major roles in determining the strength of compounding. The growth potential is greater the higher the rate of return. Additionally, the compounding impact increases with the length of the investment term. This emphasizes the need of beginning early and continuing to invest over protracted periods in order to fully benefit from compounding.

Examples Illustrating the Impact of Compounding

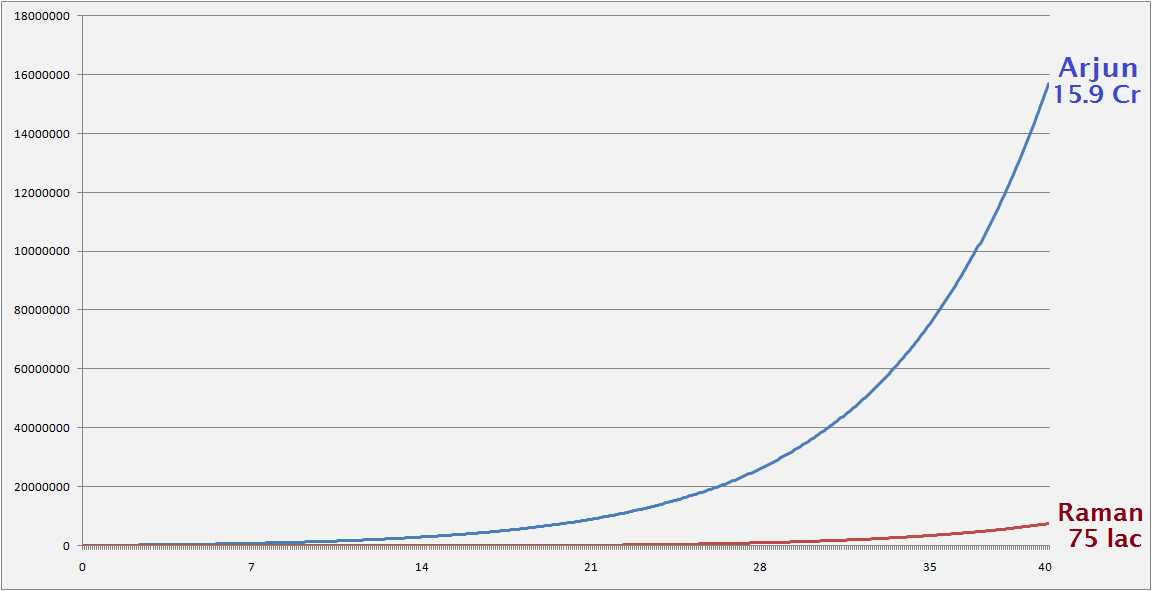

To grasp the true power of compounding, let’s consider a few illustrative examples.

Example 1: The Early Investor

At the age of 25, Arjun, a savvy investor, starts contributing Rs. 5000 each month to a retirement account. Arjun would have amassed almost Rs. 15.702 Crores by the time he turns 65, assuming an average yearly return of 15%. Surprisingly, he would have contributed just Rs. 24 Lac towards that total. Compound interest would result in a balance of Rs. 15.462 crore.

Example 2: The Late Starter

Let’s now compare Arjun’s circumstance to that of Raman, who delayed and began investing at the age of 45. By the time Raman is 65, assuming the same monthly investment of Rs. 5000 and an identical yearly return of 15%, he will have amassed about Rs. 75.80 Lacs. Raman would have lost out on almost Rs. 15 Crore compared to Arjun, which is still a sizable figure and illustrates the benefit of getting started early.

These illustrations unequivocally show the enormous influence that compounding has on the development of long-term wealth.

Practical Tips to Maximize Power of Compounding

We will now present some of the tips and tricks for maximizing the power of compounding.

Start Early

The most important aspect of utilizing compounding is to get started as soon as feasible. When it comes to creating large money through compounding, time is an investor’s biggest ally. Early contributions of any size can rise greatly over time, even when they are little.

Stay Consistent

To keep compounding moving forward, regular contributions—whether in the form of savings or investments—are essential. Consistency ensures the compounding impact continues to be powerful by allowing for a consistent accumulation of gains.

Seek Higher Returns

Compounding works with any rate of return, but aiming for greater yields can greatly increase the potential for wealth accumulation. However, it’s crucial to strike a balance between the desire for larger returns and the dangers involved, as well as to maintain a diverse investment portfolio.

Reinvest Dividends and Returns

Reinvesting dividends, interest, and other returns is essential to fully utilize compounding. Reinvesting these returns back into the investment vehicle will allow them to multiply rather than being withheld.

Be Patient

Compounding is a long-term tactic that calls for restraint and patience. Over a long length of time, compounding’s true power becomes apparent. Resist the need to continually track short-term market changes and instead concentrate on the potential for long-term prosperity.

Take Advantage of Tax-Advantaged Accounts

Use the tax advantages provided by our tax rules, such as 80C, NPS, or other retirement plans. Your assets can compound more quickly in these accounts because they provide tax advantages like tax-deferred or tax-free growth.

Increase Contributions over Time

Consider raising your payment levels as your income rises or as your financial situation becomes better. You may speed up the compounding effect and improve your ability to accumulate wealth by continuously adding additional money to your assets.

Diversify Your Investments

For risk to be controlled and profits to be maximized, diversification is essential. Invest in a variety of asset types, such as mutual funds, equities, bonds, and real estate. With time, this diversity can boost your portfolio’s overall performance and help spread risk.

Revisit and Adjust Your Strategy

Make sure your investing plan is in line with your financial objectives by periodically reviewing and reevaluating it. Adjusting your strategy when market conditions and your personal situation change can maximize your compounding potential.

Educate Yourself

Continue to learn about investing, compounding, and personal finance. Keep yourself updated on financial strategy, investment opportunities, and market movements. You will be better able to make wise selections the more you comprehend compounding.

Over time, the astonishing power of compounding may turn small savings into significant riches. Long-term financial success may be achieved by using the laws of compounding, starting early, maintaining consistency, and making wise investment decisions. Keep in mind that compounding involves persistence, self-control, and future-oriented thinking. Accept the magic of compounding now, and you’ll see your financial objectives materialize tomorrow.