Canara Bank reported a net profit of Rs 3,175 crore for the March quarter, an increase of 90% YoY. In the same quarter of last year, this figure was Rs 1,666 billion.

The fourth quarter’s net interest income (NII), which is the difference between the interest earned and the interest spent, increased by 23% year-over-year to Rs 8,616 billion. In the same quarter last year, it was Rs 7,006 billion.

Operating profit for the lender was Rs 7,252 crores during the quarter ending March, representing a 17% increase YoY.

Canara Bank has improved its asset quality compared to a period a year earlier. The gross non-performing assets ratio (GNPA) decreased from 5.89% in March 2022 to 5.35% at the end March quarter.

The ratio of net non-performing assets has also decreased to 1.73% by March 2023, from 2.65% in March 2022.

Company Financials

The provision coverage ratio of the bank was 87.31% as at the end March quarter, compared to 84.17% at the same time last year.

Global deposits were Rs 11,79 lakh crore at March 2023, a 12% increase YoY.

The bank’s domestic deposits stood at Rs 10,94 lakh crore by the end of the third quarter, a growth rate of 6% year-on-year.

Housing loans increased 14% to Rs. 84,364 Crores YoY. Retail lending rose by 11% to Rs. 1.4 lakh crores.

As of March 2023 the bank’s capital adequacy stood at 16.68%, with Tier-I being 13.78%.

The Board of the lender has recommended that shareholders receive a dividend equal to Rs 12 per equity shares (i.e. 120%), based on the face value of each Rs 10 share for the financial years 2022-2023.

As of the quarter ending March, the lender had 9,706 branches, of which 3048 were rural, 2742 semiurban, 1991 urban, 1925 metro, and 10726 ATMs.

The board, based on the performance of the bank, has decided to give 15 days’ salary to employees as a performance-linked incentives (PLI).

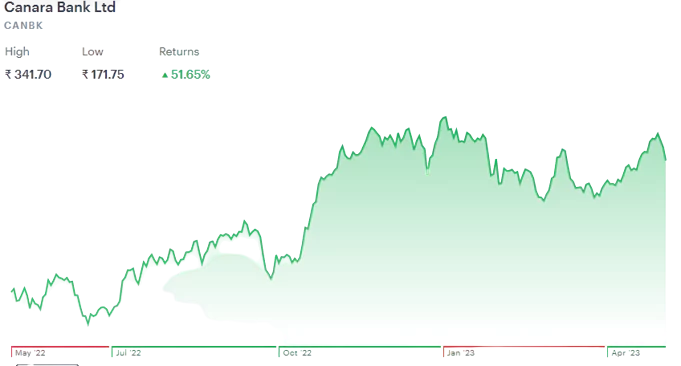

Canara Bank shares were trading at Rs. 316.40 per share on Monday after the results. It has risen 51% in the last year..