Have you run into huge credit card debt and don’t know what to do ? Well, paying off credit card debt should be a top priority due to its high-interest rates that can quickly accumulate and make repayment more challenging. Here are a few steps that may help:-

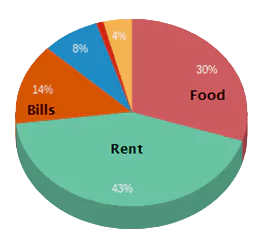

Establish a Budget

Begin by creating a budget to track both monthly expenses and income. This will enable you to identify areas in which spending could be reduced to free up more cash to put towards paying down debt.

Prioritize high-interest Debt

Make a list of all of your debts, prioritizing those with the highest interest rates (credit card debt typically comes first). Make minimum payments on these, while prioritizing paying off higher-interest ones first.

Consider a Balance Transfer

With good credit, it may be possible to transfer your debt onto a card with lower interest rates in order to save money on interest and pay down debt faster.

Use Your Savings

Although saving some cash for emergencies is important, using some of your savings could save more in interest by paying off debt quickly than by earning interest on savings alone.

Create a Debt Payoff plan

Once you’ve created a budget and determined how much money can go toward paying off your debts, make a plan to eliminate them as quickly as possible. Talk to your bank which has issued the credit card and ask tell them about your debt payoff plan. Consider using one of the debt avalanche or debt snowball methods to stay motivated and track your progress.

Debt repayment takes patience and dedication but is well worth your efforts if you want to achieve financial freedom.