Varun Beverages has reported a massive growth of 68.8% year-on-year in its consolidated profit, which was Rs 429.07 Crore for the quarter ending March 2023. This growth is attributed to strong topline growth and improvements in margins, as well as a transition to a reduced tax rate.

The company reported that its revenue for the first quarter was Rs 3,893 crores, an increase of 37.7%, driven by a robust volume growth.

Varun Beverages is the second largest bottling company for PepsiCo beverages outside of the US. It follows the calendar year (Jan-Dec) to determine its financial year. The stock price was trading at Rs 1,424 on the NSE.

The company reported that its net realisation increased by 10.4% to Rs 173.7 a case, primarily due to a price increase on selected SKUs and continued improvements in the mix smaller SKUs (254 ml), particularly in the energy drinks segment.

The company’s sales volume for the third quarter increased by 24% to 224.1 millions cases, compared with 179.7 million cases during the same period in last year. This was due to strong demand.

The operating performance also improved as EBITDA (earnings after interest, taxes, depreciation, and amortization), a measure of earnings before interest, taxation, depreciation, and amortization, grew by 50.3% on an annual basis to Rs 798 Crore, while margins increased by 170 basis points YoY, to 20.2%, for the March 2023 quarter.

Varun Beverages’ gross margin in Q1 increased by 89 basis points to 52% on an annual basis due to marginal savings made by raw material suppliers and an improved product mix.

The company’s chairman Ravi Jaipuria said, “Despite weather disruptions that occurred in certain parts of India during March, the company had achieved a remarkable financial and operational performance.”

Jaipuria stated that the company’s expansion plans include a greenfield production facility in Kota, Rajasthan, and brownfield expansions at six facilities. He added that the Plant in Jabalpur MP, which is expected to become operational very soon, will be a greenfield facility.

Varun Beverages announced that the board of directors had approved the splitting of equity shares in the ratio of 1:2.

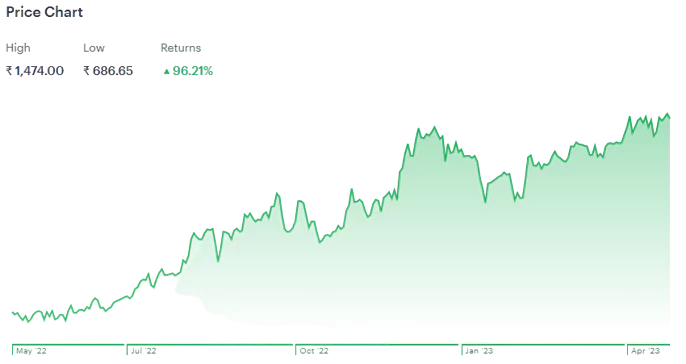

It may be noted that the stocks of Varun Beverages has given a return of 96% in the past one year.