TVS Motor Company reported on Thursday a 49% increase in its net profit for the March 2023 quarter. The net profit for the quarter ended March 2023 was Rs.410.27 crore, compared to Rs.274.50 in the same period last year.

The revenue from operations for the current quarter increased by 19.4%, to Rs. 6,604,78 crores as compared to Rs. 5,530.31 crores in the same period last year.

EBITDA for the fourth quarter was higher by 10.3%. TVS Motors’ operating EBITDA for the fourth fiscal quarter was Rs.680 billion, a 22% increase over the Rs.557 billion in the previous quarter.

In the quarter ending March 2023, the total two-wheeler/three-wheeler sales including exports were 8.68 lakh units compared to 8.56 Lakh in the previous quarter.

The quarter which ended in March 2023 saw motorcycle sales of 3.89 lakh units, compared to 4.42 lakh in the March 2022 quarter. Scooter sales grew 30% for the quarter ending March 2023, registering 3,40 lakh units compared to 2,62 Lakh units during the fourth quarter of 2021-2022.

In FY 22-23, the revenue from operations increased by 27% to Rs. 26 378 crores, compared with Rs. In FY21-22, revenue from operations was Rs. 20,791 crores. Profit after Tax (PAT), for the fiscal year ending March 2023, was Rs. 1,491 crore compared to Rs. The year-end March 2022 reported 894 crores.

TVS Motor Company’s overall sales of two-wheelers and three-wheelers for the year ending March 2023 grew 11% to 36.82 lakh units, as compared to 33.10 lakh units in 2021-22.

The fiscal year ending March 2022 saw 17.32 lakh units sold, compared to 17.33 lakh units during the previous year.

Outlook of Brokerages

UBS, a brokerage firm, has raised its target price to Rs. 1,430 and maintained its Buy rating for the stock. 1,430. TVS is believed to have delivered margins despite a poor product mix and the ramp-up of electric vehicles. UBS believes that TVS’s financial performance in 2024 will be boosted by market share gains, comments on the EV franchise and the success of Jupiter 125, Raider, and Raider.

JPMorgan believes that TVS’s management commentary ticked off all the boxes, and expects exports will grow in the second quarter of the current financial period. The note stated that the only negative was that increased investments had delayed Free Cash flow delivery. JPMorgan’s overweight rating for TVS is Rs. 1,330.

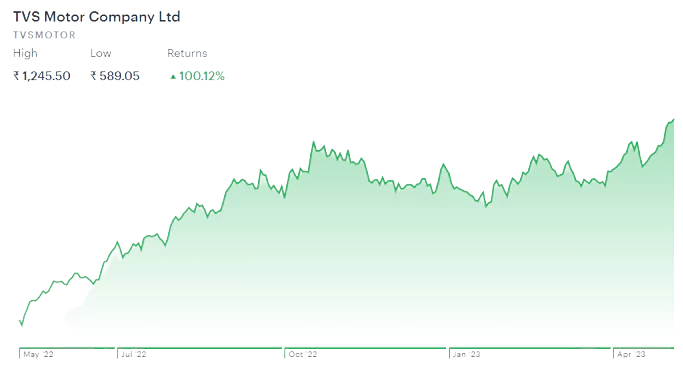

Stock Performance

The company’s share price has risen 100% in last 52 weeks and ended on Wednesday at 1,241.05 on the BSE.

There is a further 20% upside movement potential in the Stock from it’s current levels.