IDFC First Bank reported on April 29, a 134% increase in its standalone net profit for the quarter ending March (Q4 FY23), which was Rs 343 crores in the previous quarter.

Net profit jumped 32.7% on a quarter-on-quarter basis.

The bank’s net interest income grew by 35% YoY to Rs 3,597 crore, up from Rs 2,669 in Q4FY22. The bank’s core operational profit increased by 61% YoY to Rs 1342 crore.

“We have built a strong foundation for the bank with a diversified customer deposits and diversified loan book. We have registered our highest ever quarterly profit”, V Vaidyanathan is the managing director and CEO of IDFC First bank.

IDFC First Bank reported in a filing to the stock exchange that its gross non-performing assets (NPAs) ratio dropped from 2.96% to 2.51% QoQ. The net NPA ratio fell from 1.03% to 0.86% QoQ.

Vaidyanathan said that the gross NPA at the bank level would be 1.84%, and the net NPA 0.46% if we exclude infrastructure financing, which is already in a rundown mode.

Provisions for the entire FY23 decreased by 46 percent compared to the previous year, reaching Rs 1,665 Crore. Credit cost was 1.16 percent versus the 1.5 percent guidance.

In a press statement, the bank stated that ROA (return of assets) increased from 0.08% to 1.13%. ROE (return of equity) also improved, from 0.75% to 10.95%.

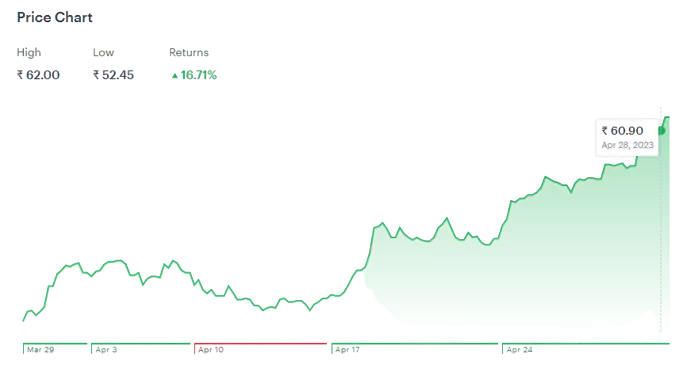

Shares of IDFC First Bank has given a 16% return in the last month and it was trading at 61.45 on Friday.