Hindustan Unilever Limited announced a standalone net profit of Rs 2,552 crores for the March quarter in FY23 – representing an increase of 9.66% year over year from Rs 2,327 billions during this same quarter in FY22.

FMCG giant Unilever reported its total revenue was Rs 15,053 Crore in Q3 2017-18, representing an increase of 10.81 percent compared to Q2.

Profit was on target while revenue fell short. According to brokerage estimates, HUL’s Q4 standalone revenue stood at Rs 15,277 crore while net profit came in at 2.584 crore. Price increases are thought to have contributed 9 percent of revenue growth and 5 percent volume expansion. Volume expansion was 5 percent as well in Q3.

Volume growth for Q4 fell below expectations at only 4 percent, which is disappointing.

The Board of Directors also suggested that the company pay out a final dividend of Rs 22 per share for fiscal year ending 31 March 2023, in addition to having paid an interim share dividend of Rs 17 on 17 November 2022.

EBITDA (earnings before tax, depreciation and amortization) totalled Rs 3,471 crore during the third quarter, an increase of 7 percent year-on-year and EBITDA margin fell 90 basis points year on year to 23.7 percent versus an estimated 23.9 percentage.

HUL reported that its Home Care division delivered another impressive performance, recording a 19 percent revenue increase and double-digit fabric wash and household product growth, as well as 10 percent expansion across beauty & Personal Care categories.

Foods and refreshments rose 3 percent year-on-year, driven primarily by an increase in food, coffee, and health food beverages (HFD).

Quarter-over-quarter gross margin increased by 120bps due to a decrease in price-cost gap.

Sanjiv Mehta, CEO and Managing director, stated, “We continue to make steady progress in future-proofing our business through portfolio transformation and building distinctive capabilities. Looking forward, the near-term operating environment is likely to remain volatile. With inflation easing due to lapping of high base and sequential softening in a few commodities, price and volume growths will rebalance. Market volumes will recover gradually as consumption habits readjust. We remain focused on managing our business with agility and growing our consumer franchise whilst maintaining margins in a healthy range.”

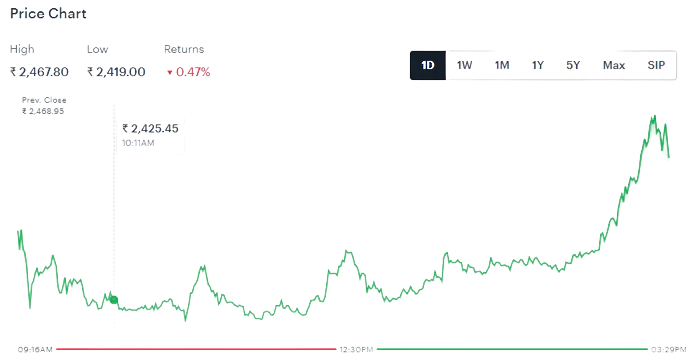

HUL’s share price fell 1.89 percent after earnings totaling Rs 2457.30 were announced, due to trading activity on the National Stock Exchange.

However the brokerages are still bullish on the stock. As per Tickertape, over 70% of brokerages have maintained a ‘Buy’ rating on Hindustan Unilever.